Millions of families in the world live in serious economic difficulties, not because they are unemployed, but because despite having sufficient income they cannot stabilize their personal finance.

In that sense, many of the problems of finance are not due to problems of compulsive buying and addiction to debts, but to the irrational impulses to buy products that are not really necessary, which are the main cause of the imbalance of the economy in its pocket.

Many times, we lead higher lifestyles than we can sustain, causing unnecessary indebtedness over time. The question is do we know how to manage our money in a systematic way? These 7 tips will allow you to ensure that your personal finances are in order before continuing to expand your business. Put them into practice and ensure your economic stability.

1. Educate yourself

Take the time to read about personal finance. Each week, schedule money appointments with yourself and spend a few hours managing your personal finances and reading books, magazines, sites or finance blogs. The more you know about your own finances, the more confidence you will have in managing your money in the long term.

2. Check your credit regularly

Your credit report is like a record of you and your credit history. Basically, it tells the lenders how risky you are, and whether or not they should lend you money. When it comes to buying a car or a house, it is desirable that your credit report is in excellent shape, so that you can qualify for good rates.

Create the habit of reviewing your history at least once a year to confirm that everything is in order. You can do it on a special date like your birthday so that it becomes easy for you to remember it and keep monitoring.

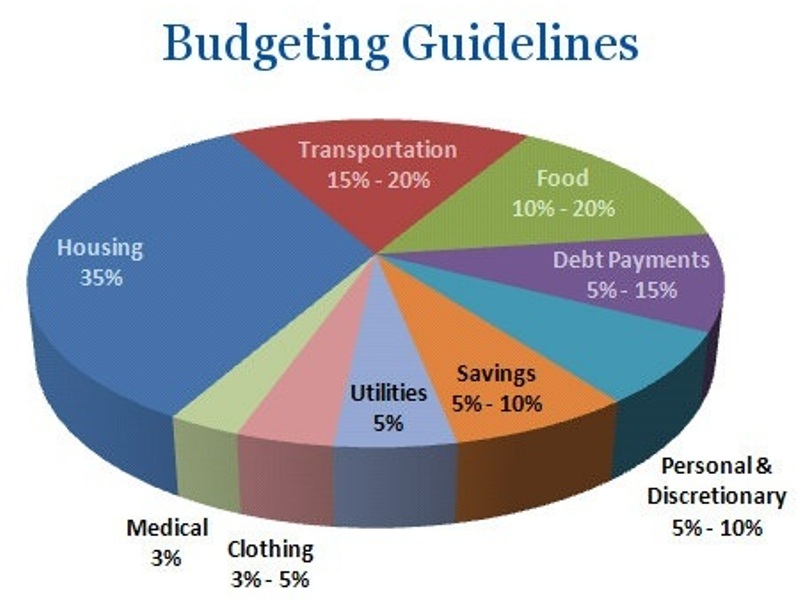

3. Make a budget

Although this sounds very basic, many entrepreneurs do not have a budget in shape to monitor their monthly income and expenses. You can use digital tools such as apps to monitor your personal finances or simply a document in Microsoft Excel. No matter which option you choose, make sure it suits your lifestyle.

If you really want to fix your finances and take the lead financially, you must allocate time and energy to update your budget every week. This will help you ensure that you do not spend more than you earn and that you are able to save for your financial goals.

4. Automate your finances

Technology greatly facilitates the task of managing finances every day. Most of the processes are automatic nowadays. You can use automatic online transfers or pay your bills online every month. This will help you not to stress for paying your bills on time and generate interest or extra charges.

If you are worried about automating the payment of your accounts, you can set alarms on your calendar or on your computer or smartphone that remind you of the payments. The more you can automate your finances, the fewer worries you will face.

5. Pay Debts

Make a plan to pay off all your debts as soon as possible. Start by making a list of all your debts credit cards, auto loan, student loans, etc. It includes the current balance, the minimum payment per month and the interest rate. Then review your budget to determine how much money you can add to debt payments.

From there you can do research on strategies to reduce debts so that you confirm that you are paying them in the most efficient way possible. When you are working on reducing debt, it is important that you have a cushion to pay for any emergency that may arise along the way.

6. Build your own emergency fund

Having an emergency fund is an essential part of your finances. It allows you to use the money to pay for unplanned expenses or emergencies that may appear in your day-to-day life.

As an entrepreneur, it is convenient that you have a fund of 6 to 12 months of your fixed expenses. This will allow you to pay personal accounts and not worry if you need to reduce your income due to business flow.

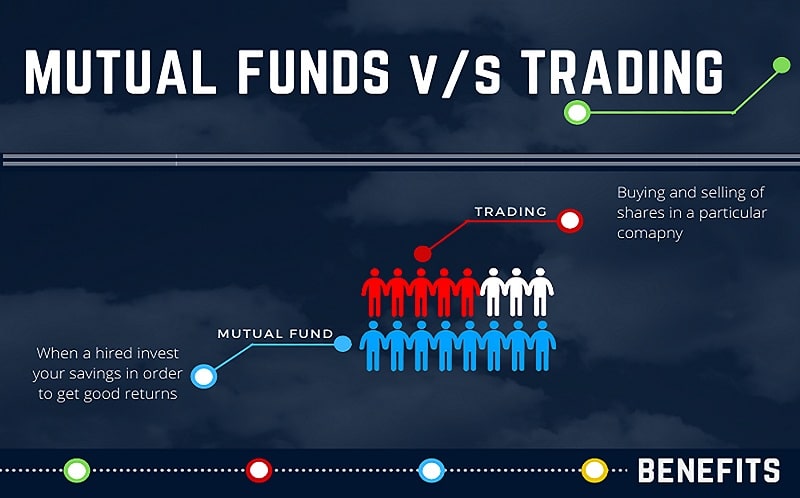

7. Invest outside of your business

Although it is very important that you always invest in your business, you should not put all the eggs in the same basket. Diversification is extremely important as it will decrease your investment risk in the long term. Work with a financial planner to create a long-term investment portfolio that includes stocks, bonds that align with your own financial goals and your risk tolerance.

Conclusion:

Healthy finances are maintained when there is a balance between your income and your expenses, which must include stable savings. Expenses must be organized taking into account the money that exists, never based on income for which there is no certainty. A crucial factor for capital accumulation is moderation.

One sure way of not using money correctly is to fall very easy in the face of rapid gratification. When you opt for this attitude you are a victim of consumerism. It is the kind of behavior that leads someone to the erratic handling of multiple credit cards, which in the long term turn into a nightmare.

It is not advisable to handle financial decisions out of impulse. Expenses require self-control and self-discipline. If you want to save, you have to cut back on some aspects. Gratification is not bad, but the motive and time must be chosen very well to do so. Thus the expenses are controlled and there is a motivation to achieve the purposes.