We all have been differentiating the two forms of investments for ages, i.e., mutual funds and stock trading. Several other options, such as money markets, bonds, real estate, are also available, making it challenging to start your investment journey. Moreover, there’s not even any assurance that you get high returns on your investment.

However, starting your investment journey by investing in mutual funds is considered safer than stocks. It is the best form of investment for people who have a low investment budget and want to be at the safer side.

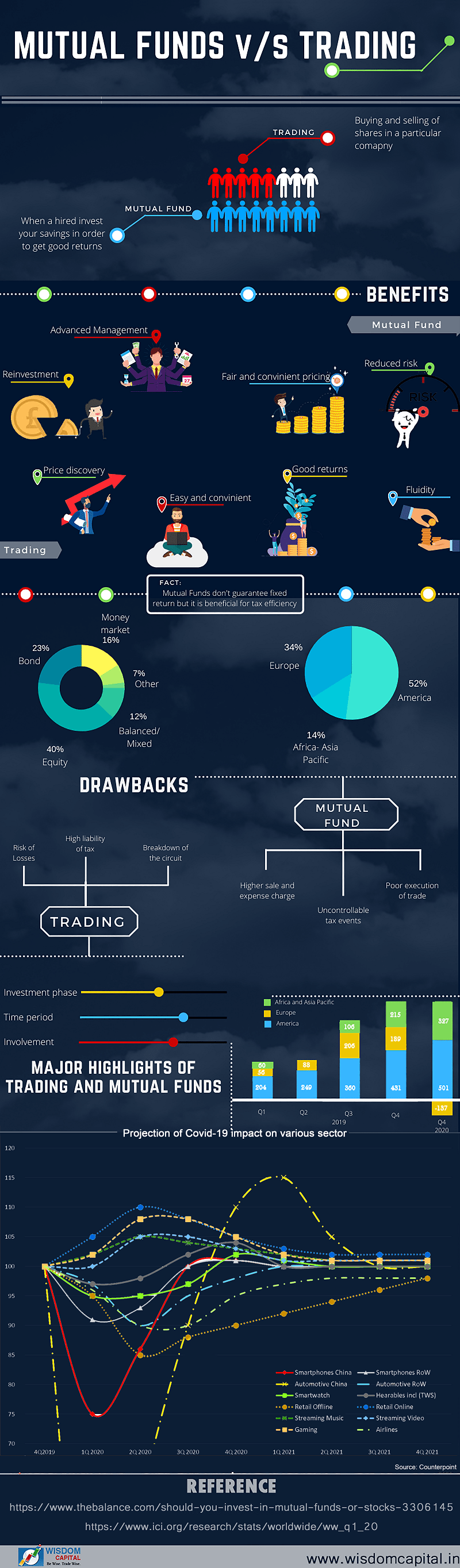

On the other hand, stock trading can also provide you significant profits, but it involves greater risks than mutual funds. You can even earn profits through stock trading, but this involves more significant risks than mutual funds. The following are some of the considerable differences between mutual funds and stock trading described in the infographic. Kindly have a look.

Tax

People who find it troublesome to pay hefty taxes should go for stock trading. The portfolio manager is the critical person who decides when to look after the gains/losses and collects your dividends. On the other hand, mutual funds involve massive tax paying. Even if the fund value drops significantly, you are liable to pay the taxes.

Age

Mutual funds provide an excellent opportunity for earning profits as there are multiple sources in which the funds get invested that assures high returns. As a beginner investor, mutual funds can help you build a diversified portfolio that can yield various benefits.

On the other hand, stock trading, being a complex form of investment, is excellent for experienced people and have sufficient market knowledge that helps them find the right equities and shares they want to invest.

Clarity

Fund performance, financial segments, market watch, and many more are the different mutual funds’ parameters, and your fund manager handles these. Hence, the transparency element in mutual funds is minimal as you are not aware of these parameters.

In stock trading, you are aware of all the stocks, the status of companies you have invested in, and the market. The schedules for the annual meetings are also shared with you via a booklet. Moreover, you also stay updated with whatever amount you have invested in shares. Hence, stock trading offers more clarity than mutual funds, as investors tend to have more control over their funds.

The infographic shows information about open-ended funds of the world, both regionally and percentage-wise. Some other differences between stock trading and mutual funds are highlighted, such as their advantages, disadvantages, and key highlights. It additionally shows information