You have worked a very long time in your life and what have you saved to enjoy the rest of it? Well, for that it is not too late if you have done the math then it will be easier for you.

There are a few tips to support your financial situations after retirement and how well you can save your money in a better responsive way. The ready meal is fine, of course, but to be savvy aware it is important that you know the essential traits of such an investment. You do not need a doctorate in mathematical finance to deal with these problems. You just need a bit of “financial education”, the basic financial culture to reveal the answer that how much do I need to retire?

Everything in your financial life seems a lot harder today. Surely you have wondered why it is so difficult to save and have a good pension. We are used to considering retirement as a matter of fact in our society, a sacrosanct phase of life. But let’s not forget that retirement is a fairly recent concept. The idea only worked for a generation or two for most of us, for our parents and our grandparents. Before, people generally continued to work as long as they could.

Create an investment portfolio

It is not necessary to open another bank account (even if it may be appropriate in some cases). It is enough to separate the portfolio, which has a specific objective, from other possible assets, to keep it under control.

Aimed at coupons and high dividends

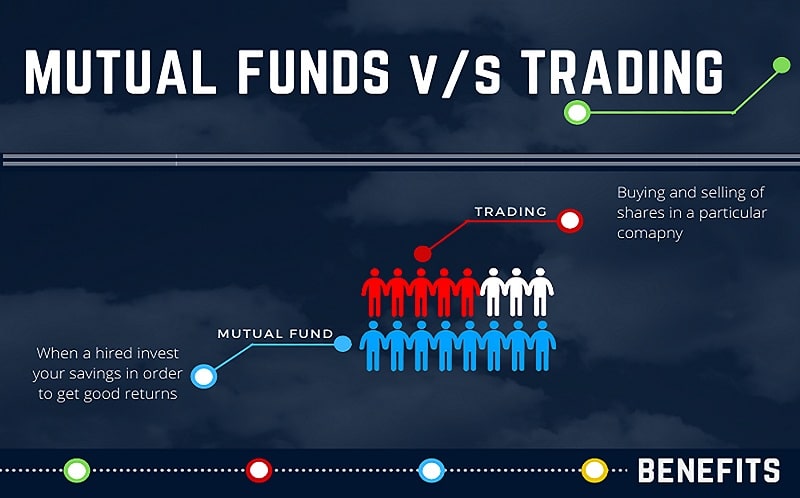

Money is mainly invested in financial instruments that can generate income on a regular basis, thanks to coupons and dividends that is the fresh cash you need. Then, choose bonds with high coupons, above the market average, bearing the fact that they are listed above par (price greater than 100). Regarding the investment in shares (directly through equities, or through ETFs and/or mutual funds, with the benefit of a good diversification), especially aimed at a high dividend yield.

Avoid large risks of permanent loss of capital

Given the portfolio’s objective, you can bear important market fluctuations well enough if you still pay coupons and dividends. But you will suffer serious harm if an investment defaults because you have lost income and capital.

Defend yourself from inflation

It is important to protect yourself against erosion due to inflation, i.e. price increasing, which ultimately reduces purchasing power. The enemy you must fear is the inflation of the country in which the income will be spent. The defense consists essentially of inflation-linked bonds (such as Italian BTPs) and short-term interest rates (such as CCTs), as well as equity investments, as they are linked to production dynamics and the real economy.

In the event of an emergency, capital may be used

Ideally, income integration should come from coupons and dividends. However, capital may be relatively small and insufficiently produced, or emergencies may occur. In these cases, with prudence and common sense, you can liquidate part of the portfolio, if it is a heritage that could be inherited, patience.

Pay attention to the liquidity of financial instruments

Buy instruments with good liquidity, so that they can be easily sold in case of emergency, otherwise, they are trouble. This is the reason why the properties are not very suitable for this investment objective: they are intrinsically illiquid.

Aim for moderate capital growth

Needless to overdo it, you already have a current income and protection against inflation. Therefore, aim for a regular growth of capital which, over a period of a certain length, should probably come down from the application of the previous rules.

Make the necessary portfolio rebalancing

Replace expired bonds. Move the portfolio a little, varying the asset allocation only in the face of clear opportunities offered by the market, for example, investments with coupons or high dividends, good fundamental, which may have suffered a sharp drop in the markets.

Do not pay unnecessary management costs

Avoid high costs. They are not necessary to have a good portfolio and have a high negative impact on the results of your investment, dragging down the performance.

Do not get caught up in the latest product offered by your bank

Avoid, and this is a corollary of the previous points, opaque and expensive tools, such as unit-linked or index-linked policies, often offered in these situations as a unique and complete solution in most cases these are expensive, rigid solutions, illiquid and inefficient.

Conclusion:

Today more than ever, it is not just finding a job to worry about it, but retirement is also a source of many doubts, both for those who should be close to it and for those who are now entering the world of work. Between changes and uncertainties, it becomes a priority to find methods to save money. There are various financial instruments, time horizons and performance expectations.

Certainly investing the money without having understood the operation of the chosen financial product or the possible consequences increases the probability of making mistakes and suffering substantial losses. On the other hand to operate in complete autonomy from institutions of various kinds, ensures transparency that added to professional competence helps to choose the most suitable investment and meets their needs, precisely because not spoiled by interests of any kind.